Online Consumer Buying Trends Throughout COVID-19 and beyond...

The last few months have been a huge learning curve for the eCommerce industry, we’ve pivoted our offerings, supported our communities, run out of stock, dealt with supply chain issues, content has become king, we’ve gone live, but the next big question on everyone’s lips is what happens next?

Will eCommerce continue to thrive or will consumers head back in-store?

Will consumer habits developed in lockdown become permanent?

Will the consumers that jumped brands for availability return to their legacy brands after lockdown?

To help make sense of the situation and to capstone our Survive & Thrive series, we’ve rounded up stats from the eCommerce industry to show what has happened so far, how consumer confidence has developed and brands that showed great initiative along the way:

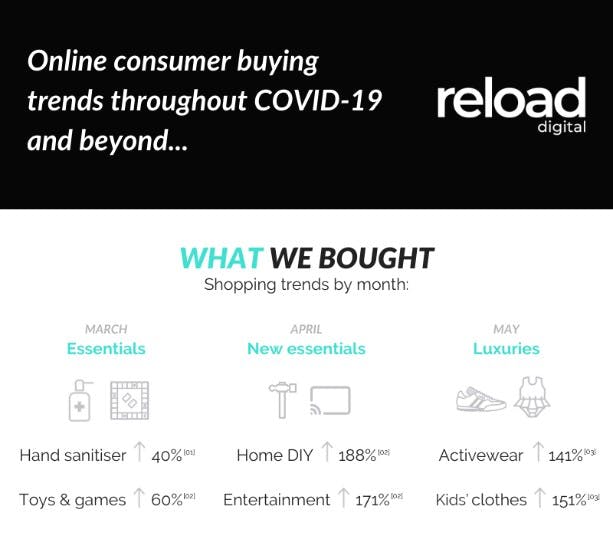

March: As the world began to live their lives from the safety of homes via a Zoom screen, our life priorities shifted immediately as did our consumer behaviour. With health and safety at the forefront of our minds, we began to prepare our home spaces, equip our families with PPE equipment and arm ourselves with activities to keep us from boredom. Enter the first COVID-19 buzzword ‘essential’ shopping, which saw order increases across household cleaning supplies (^ 34.95%), toilet paper (^ 30.85%) hand sanitisers (^ 40%) medical items (^ 22%) and toys & games (^ 60%) to name some.

At this stage 41% of us were shopping online for things we’d normally purchase in-store and we had the luxury of choosing our online purchases based on quality (48%), price (47%) and brand (24%) something we took for granted until April & May where we moved towards a focus on availability.

In the beginning, brands took this time to communicate their admin stance on COVID-19, sending emails from their CEO’s informing us of their plans to carry out business. But the best brands were doing more than this, they were innovating their offerings to get us products we needed and helping people who really needed it.

Brands we loved in March:

Bite Toothpaste founded on the belief that they can make a difference innovated their product offering to create hand sanitiser for the homeless.

So Ill expanded their climbing apparel range to include face masks partnering with a First Responders Children’s Foundation.

April: We strapped ourselves in for another month of lockdown with one mission...keep ourselves busy! We got stuck into DIY jobs ordering ^188% more products than 2019 and we watched Netflix and Disney+ until our hearts were content with 5 million British households signing up to watch during lockdown.

But with Netflix, comes online shopping and as first time eCommerce laggards jumped on board the online shopping club, our count increased by 8%. This was an interesting time to become part of the club as availability became an issue for the first time in COVID-19 and our buying factors turned to availability (49%), price (36%) and quality (34%).

While some brands late to the party were still addressing their communities with CEO emails (a gesture that had lost all sentiment by now) others took to the hashtags with #supportsmallbusiness to help those suffering in the economic downturn and urged consumers to support local stores with gift cards. But the brands that really turned heads were those offering philanthropic support to our hero key workers.

Brands we loved in April:

Astrid & Miyu were connecting their community with local charities to keep people busy while supporting our NHS & aged care.

ARK Skincare were gifting care packages to key workers via community nominations on their social communities.

May: Marking 5 official weeks of lockdown, at this point we had binge watched Tiger King in our loungewear and we were all ready for a little luxury. Our order counts were up YoY as we bought snazzy face masks (^285%) Kids clothes (^151%) and activewear (^ 141%). Clearly we had some outdoor exercising plans or maybe we just wanted to try something new? 40% of us admitted to buying new products due to advertising, necessity or just plain boredom. One thing was for sure in May though, we wanted our activewear and face marks with a contactless exchange seeing a 50% increase curbside pickup.

At this stage, CEO emails from brands were no longer acceptable, in fact 77% of us were tired of the COVID-19 chat entirely and pushed for brands to communicate their product offerings in a useful way that could relate to our lockdown mindset.

Brands we loved in May:

Oui the people released homebody kits realising there was little we could control at the time except small moments of self-care extended to ourselves and the ones we love.

Next leading the retail click and collect way allowing customers to order online and collect at a store within 1 hour.

Our 2020 predictions:

Looking forward, observing countries who are ahead of us post lockdown and taking into account industry research, we have 3 predictions as to how we expect consumer behaviour to continue:

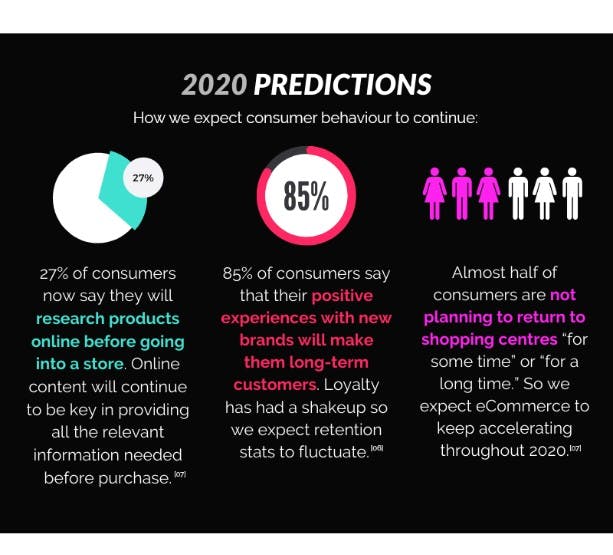

- eCommerce will continue to thrive with nearly half of consumers not planning to return to shopping centres “for some time” or “for a long time.”

- Content will continue to be key as consumers begin offline purchases online with 27% of consumers researching products before going into stores once the outbreak ends.

- Loyalty has had a shakeup so expect retention stats to fluctuate. 85% of consumers say that the positive experiences that they have with new brands will make them long-term customers.

If you want to chat through any points of this article, or get 5 actionable recommendations to help improve your eCommerce performance right now, please do get in touch!