How the online Luxury Fashion industry and customer changed in 2021

In an ever-changing economy and eCommerce landscape, no industry is above the effects of the last few years. Think COVID-19, economical turmoil with the rising cost of living and not to mention Brexit (sorry). We’ve seen stark differences in every sector, with customers adapting to the ‘new normal’ (again, sorry).

But when it comes to Luxury Fashion, we’ve seen a complete 180°, with changes in shopping patterns, new customer focus’, stock and supply-chain issues whilst adapting to ever-changing restrictions.

What exactly did 2021 bring to the Luxury Fashion sector? In this article, our Luxury Fashion expert Maddie discusses setbacks, innovations, trends and new customer behaviours and how these impact brand’s marketing strategies.

What actually happened within the Luxe Fashion market?

Well, changes in lockdowns and restrictions across the world meant a complete shift in customer behaviour. Compared to a year majoritively in lockdown in 2020, searches for Mini dresses and high-heels significantly grew by 221% YoY (according to Lyst) due to the easing of restrictions across the world.

Suggesting that as COVID-19 is becoming an issue we’re having to live with, rather than eradicate completely, the impacts of COVID are likely to continue to influence eCommerce trends for the foreseeable future.

The shift in how the fashion season has historically worked may result in a completely different landscape going forward. The term ‘fast-fashion’ is becoming increasingly distasteful, with a general consensus of buying better yet less often.

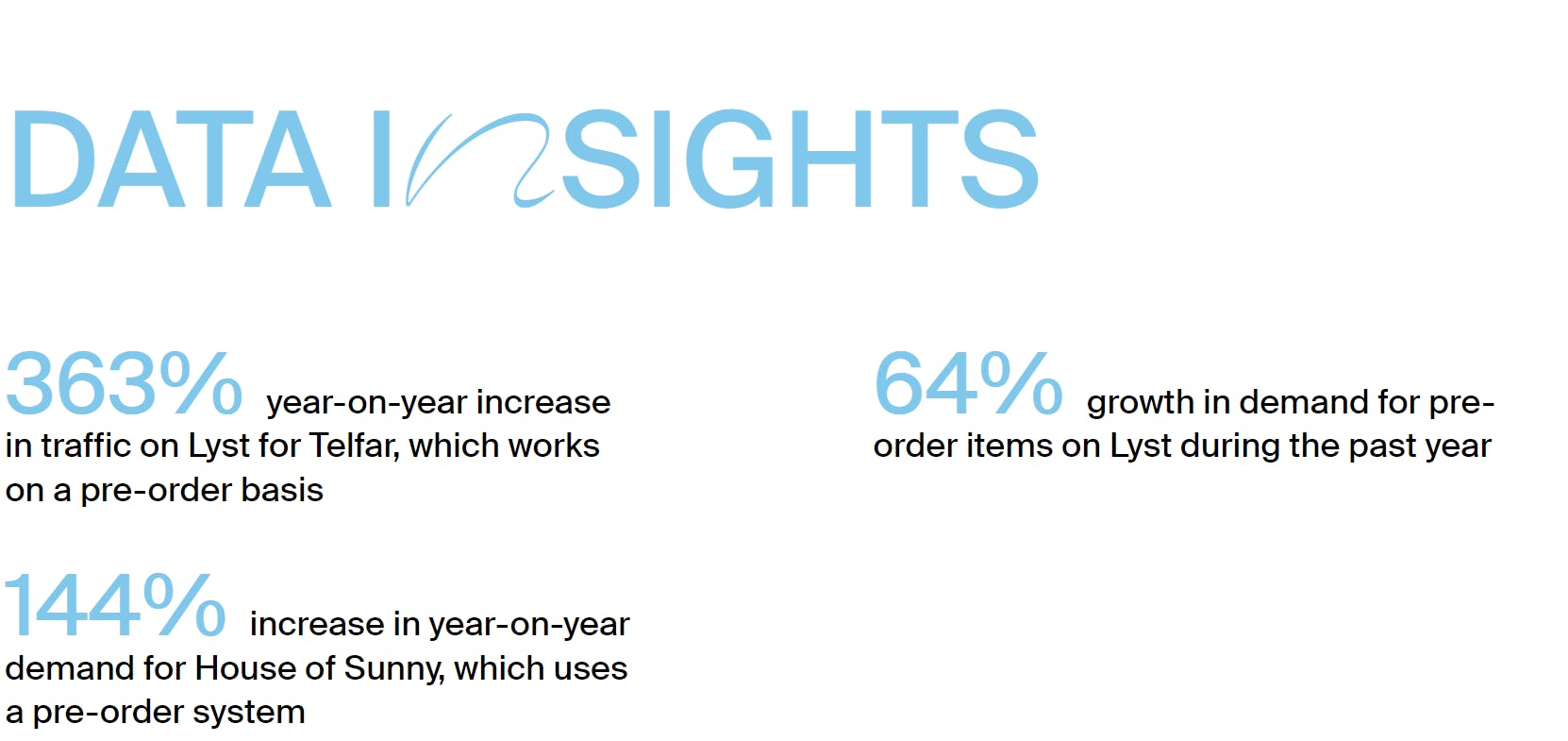

More brands than ever are opting for pre-order drops such as Khaite and House of Sunny to name a few, with Lyst seeing a 64% growth in demand for pre-ordered items.

This promises exclusivity, which is something the luxury fashion industry has always favoured, along with cult-status, instagramable pieces like the Telfar-Ugg sheepskin bag.

The London Fashion Week for Men in January 2022 has been cancelled due to Omicron worries and with plans for Men’s and Women’s to be mixed in the February and September slots.

Suggesting the luxury fashion calendar has more room for manoeuvrability than ever before, with the potential to offer a more sustainable framework in event logistics along with pre-ordering options, see-now-buy-now and smaller capsule collections on offer.

However, it wasn’t just the luxe fashion market that had an upheaval…

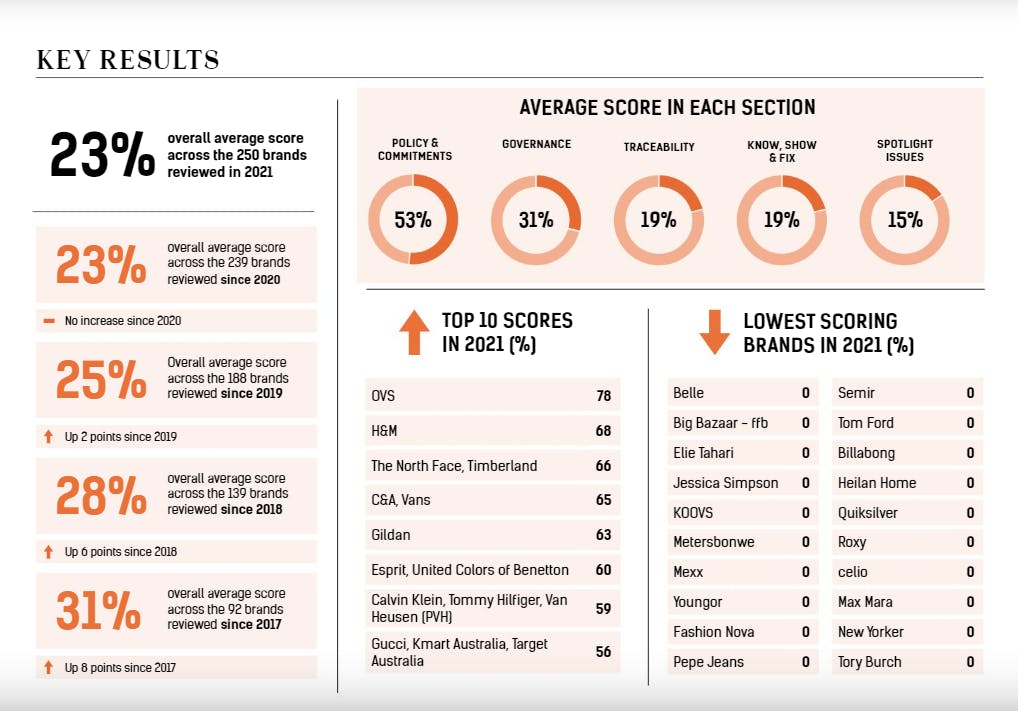

Shopping sustainably and being conscious consumers has become a huge new focus, with COP-26 in the latter part of the year along with more celebrities and influencers promoting eco-minded fashion initiatives than ever before.

The likes of Emma Watson, Jessica Alba and Kate Middleton have become hugely influential in sustainable business and fashion, showing a better way to purchase as a conscious consumer along with accepting responsibility to make change as business owners.

But, what brands are doing the most?

Here’s a list of our favourite brands with sustainable frameworks that are pioneers in this sustainable fashion space:

What we’ve seen in the last few years is the larger behemoths of the luxury sector feeling the pressure to adapt and - with the remainder of the industry following suit - working hard to not get left behind.

We can look to the big hitters such as Burberry and Gucci for their new initiatives that have been vital in ensuring climate change is not an issue this industry willing to ignore (any more).

Take the Nike x Billie Eilish collaboration, for example, showcasing vegan trainers and in turn, Lyst saw the search increase for vegan trainers go up by 67% and biodegradable trainers increase by 348% YoY.

A huge new focus has emerged on a waste-not-want-not mentality. More designers than ever are embracing the upcycling trend, look at Marine Serre, (designer to the likes of Asap Rocky, Rihanna and Harry Styles) who only uses deadstock and recycled materials.

How does this new attitude influence the luxe fashion customers purchasing habits?

This goes even further than using deadstock for designs… with the luxury second-hand market growing at an exponential rate, reportedly four times faster than the primary luxury market. Statista Research Department reported the growth at 12% per year versus 3% respectively.

Now the customers are in the driving seat, the luxury-fashion giants are becoming increasingly more adaptable and aware of this shift in customer habits.

Kering, the conglomerate which owns Gucci, Alexander McQueen and Balenciaga invested in the luxury reselling platform Vestiere Collective this year, reportedly now owning a 5% stake (source: Drapers).

Customers are reinforcing this eco-focus by reducing their carbon footprint by a whopping 82% by purchasing used items over new pieces. This opt for vintage and second-hand is a clear option for the new climate-conscious generation.

And who is this new generation of customers?

The luxury market is about to see the biggest change in its demographic in modern history. Let’s get into the statistics here… Bain.co.uk reported:

But, what does this mean for luxury fashion brands?

It means that more importantly than ever before, brands need to listen, adapt and communicate in a more relevant way to these customers.

How do they do this?

By keeping an ear to the ground, hiring talent who understand the generational nuances and can communicate authentically through relevant channels.

And, as the average age of customers is declining, whilst the cost of living rises steadily. Resulting in these younger consumers looking to promotional activity as one of the main drivers through to purchase.

The fashion network reported that 68% of Millennials say they had become more responsive to promotions. Therefore, even luxury brands may have to consider the promotional activity as entry into acquisition for this increasingly young consumer base. Especially when competing with e-tailers like Farfetch and Net-a-porter, which employ this tactic.

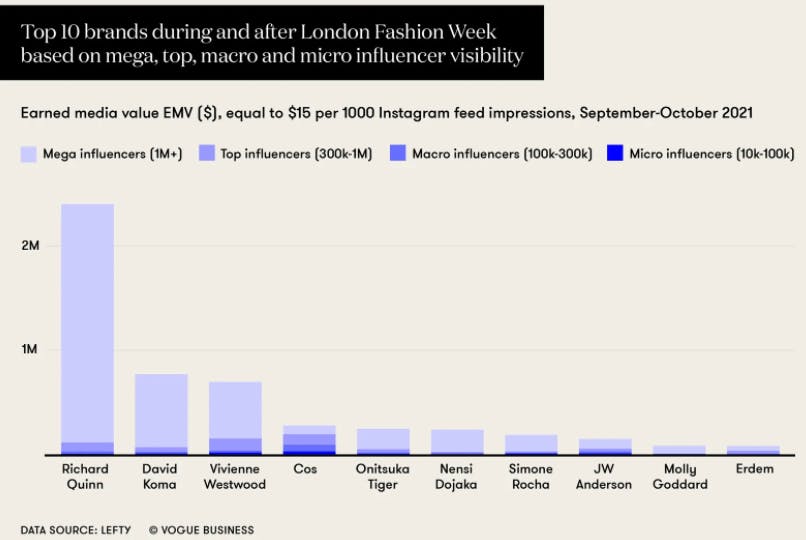

Brands that will perform best understand what their customers want from them, not only on a product level but in a social, community context too, whether this is via social channels like Instagram or TikTok or through other innovative avenues.

What channels are best to invest in to capture this new customer?

More people than ever before are purchasing luxury fashion online, meaning target customers are more diverse and increasingly more difficult to categorise.

Therefore, increasing difficultly in customer segmentation and targeting through prospecting and paid advertising. Making the job of marketers more difficult within this sector.

Another monumental shift in the industry (impacted by COVID), has been the decline of in-store footfall. Over Black Friday, Drapers reported that footfall declined by 15.8% compared to the same timeframe in 2019.

Diane Wehrle, marketing and insights director at Springboard, said:

Bain & Company have predicted online to become the leading channel for luxury purchases by 2025, fueling omnichannel transformation.

So, how can brands capitalise on this shift?

Continue to invest in performance channels and branded marketing to ensure a consistent narrative through every touchpoint along with reaching all potential customers at every stage of the funnel.

For more information on how to develop a concrete brand and performance strategy, read our General Manager Adams latest article on Brand vs Performance marketing campaigns, here.

Rather than waiting for a prospective customer to walk into their store and purchase, the chase is now on for brands.

They now must seek out these prospective customers and ensure to establish brand affinity over social and performance channels, out of home marketing along with moving in-store experiences to a virtual space.

So, the time has never been more important to invest in your brand’s content by fostering a community, along with adopting a holistic approach to your marketing strategies. Ensuring brands stand out whilst being adaptive in an oversaturated luxury crowd.

How can brands standout from the crowd?

By ensuring their brand’s unique personality is adopted consistently across every touchpoint and looking at digital trends while exciting customers with new and innovative experiences, initiatives and product.

One way brands can do this is through unexpected collaborations, 2021 saw more interesting and innovative collaborations than ever before from:

But it’s not just fashion brands who are collaborating together. Look at Balenciaga x The Simpsons Spring/Summer 22, the collaboration no one expected but resulted in their page views spiking by 355% in just 24 hours.

Palace x Stella Artois and Heron Preston x Mercedes also show that the possibilities are truly endless, it seems the more out-there the collaboration, the more this piques the customer’s interest. Showing the brands adaptability and creativity.

But it’s not just innovative collaborations this new luxury fashion customer wants. It’s real-life experiences… virtually (yes, you read that right).

Facebook well, Meta, coined it, but the Metaverse is the next destination for luxury fashion (more on this to come in our Fashion industry trends of 2022 article).

Brands must develop their virtual offering as customers rely much more on virtual experiences and destinations.